how much child benefit and child tax credit will i get

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. The Child Tax Credit provides money to support American families.

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22278947/Screen_Shot_2021_02_03_at_1.22.58_PM.png)

. If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children. This credit is part of Connecticuts 2022-2023 budget bill which was signed into law by Governor Ned Lamont in May.

The taxpayers earned income and their adjusted gross income AGI. To qualify for the maximum amount of 2000 in 2018 a single. A childs age determines the amount.

Here is some important information to understand about this years Child Tax Credit. The percentage depends on your income. It will not be reduced.

The Child Tax Credit will begin to be reduced below 2000 per child if an individual reports an income of 200000. If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each of your. Max refund is guaranteed and 100 accurate.

How Much Is The Child Tax Credit. If your AFNI is under 32797 you get the maximum amount for each child. You must contact the Child Benefit Office if you.

6997 per year 58308 per month 6 to 17 years of age. Have been a US. For parents of children up to age five the IRS is paying 3600 per child half as six monthly payments and half as a 2021 tax credit.

Families could be eligible to. Families with 60 million children were sent the first monthly check for the Child Tax Credit on July 15That federal benefit is providing about 15 billion in. We dont make judgments or prescribe specific policies.

Under 6 years of age. The amount you can get depends on how many children youve got and whether youre. Rate weekly Eldest or only child.

See what makes us different. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Two Factors limit the Child Tax Credit.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Families can still receive child tax credits if eligible Credit. Amount of Universal Credit.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. About 35 million US. Free means free and IRS e-file is included.

Number of children. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

The payment for the. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. There are 2 Child Benefit rates.

Tax credits calculator - GOVUK. For 2021 eligible parents or guardians can. For married couples and joint filers the credit will dip below.

Who the allowance is for. Already claiming Child Tax Credit. 28250 born before 6 April 2017 23708 born on or after 6 April 2017 Second child and any other eligible children.

Making a new claim for Child Tax Credit.

The Canada Child Benefit Ccb Explained Benefit Tax Tax Prep

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

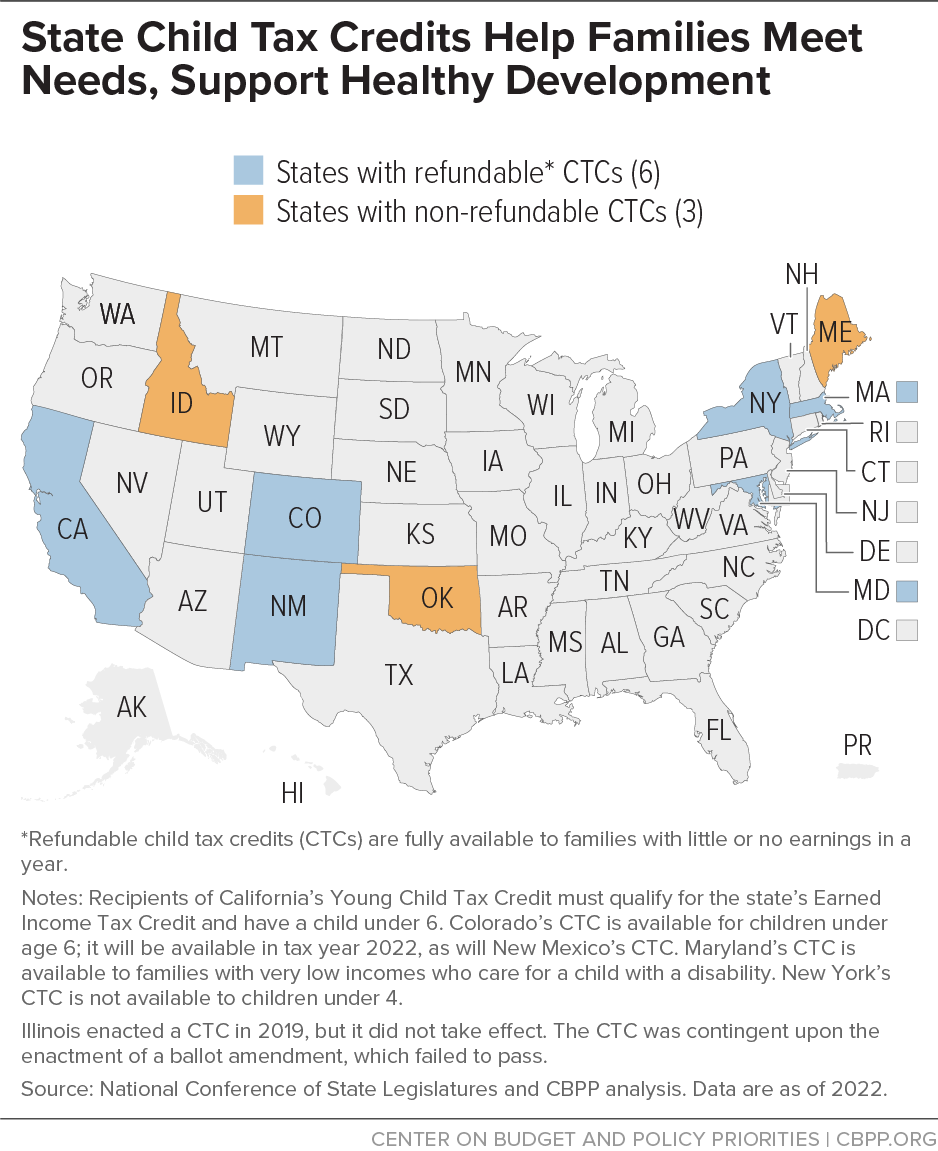

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Benefit Payments 2022 Bank Holiday Payment Dates

Free Childcare In Scotland How To Guide Childcare Childcare Costs Early Learning

The Child Tax Credit Toolkit The White House

What You Need To Know About The Child And Dependent Care Tax Credit Tax Credits Tax Essential Oil Samples

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

Child Tax Benefits From Daycare To Swim Lessons Swim Lessons Lesson Art For Kids

/cdn.vox-cdn.com/uploads/chorus_asset/file/6520933/child_allowances_chart.jpeg)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

Romney S Child Allowance Improves On Biden Proposal People S Policy Project

/cdn.vox-cdn.com/uploads/chorus_asset/file/6521033/working-family-tax-credits-1.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/6522525/Child-benefit-comparison.0.png)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/22278947/Screen_Shot_2021_02_03_at_1.22.58_PM.png)

Mitt Romney S Checks Plan Up To 350 Per Month Per Kid For Parents Vox

The Child Benefit Building Blocks Infographic Allowance For Kids Money Advice Infographic Health

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit Definition Taxedu Tax Foundation

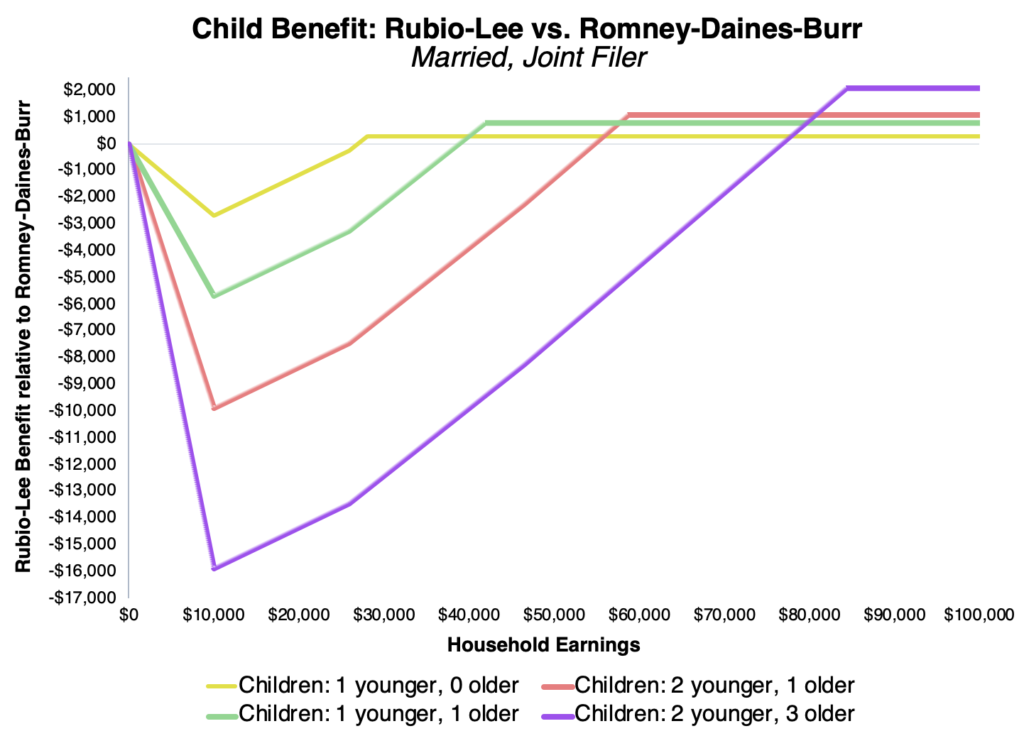

Comparing Rubio And Romney S Child Benefit Proposals Niskanen Center